Effortless Expense Categorization & IRS Compliance for Medical S Corp

About the

company

A practicing physician operating an S Corporation sought efficient financial management to organize expenses and ensure IRS compliance. Facing challenges in expense categorization and IRS requirements, the client needed support to manage the complexities of their S Corp’s financial records.

The Challenge

Operating as an S Corporation, the client required accurate expense categorization and detailed IRS-compliant expense breakdowns. With time constraints and intricate business management, organizing expenses and ensuring IRS adherence was a daunting task, risking potential compliance issues.

The Solution

YourLegal, specializing in bookkeeping for healthcare professionals and S Corporations, provided tailored assistance. Our team meticulously reviewed the client’s financial records, categorizing expenses and ensuring alignment with IRS regulations.

The impact of our

collaboration

Thorough Expense Categorization:

YourLegal accurately categorized the client’s expenses, allocating them according to IRS guidelines. Expenses were organized into specific categories, such as supplies, equipment, maintenance, salaries, etc.

Detailed Expense Documentation:

Comprehensive documentation detailing each allowable expense was prepared, substantiating their legitimacy. This meticulous record-keeping was crucial for IRS compliance and substantiation.

Compliance and Reporting:

YourLegal ensured all categorized expenses complied with IRS regulations and S Corporation tax requirements. Detailed reports were provided to facilitate the client’s understanding of deductible expenses and aid in tax preparation.

Consultation and Support:

Throughout the process, YourLegal offered ongoing consultation, addressing inquiries and providing proactive advice on optimizing expenses within the IRS framework.

Results: The collaboration with YourLegal yielded impactful outcomes:

Accuracy and Compliance

The precise categorization and detailed documentation ensured IRS compliance, reducing the risk of audits or penalties due to inaccuracies.

Time Efficiency

YourLegal's support saved the client valuable time, allowing a focus on patient care and practice growth while entrusting financial aspects to experts.

Maximized Tax Benefits

The detailed expense breakdown facilitated seamless tax preparation, enabling the client to leverage legitimate deductions for optimal tax benefits.

Confidence

The client gained assurance in financial records, knowing that S Corporation expenses met IRS standards

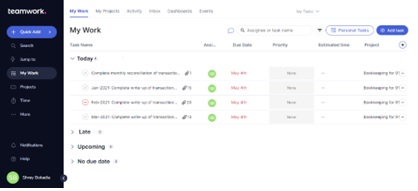

Tech Stack

Value Delivered

Through meticulous expense categorization and detailed documentation aligned with IRS guidelines, YourLegal empowered the client to navigate S Corporation expenses confidently. This partnership ensured compliance, optimized deductions, and provided financial stability.

At YourLegal, we continue to support healthcare professionals, providing specialized bookkeeping services tailored to unique needs, ensuring compliance, and fostering financial success.