How Expert CPA Solutions Ensure Timely IRB Report Preparation

About the

company

A leading CPA firm based in Canada specializing in forensic accounting, valuations, and corporate taxes. The firm offers a range of services, including financial investigations, valuations, and corporate tax assistance, to a variety of clients including businesses, government agencies, and individuals.

The Challenge

The firm was unable to keep up with demand for Income Replacement Benefit (IRB) Reports for insurance claims due to lack of internal resources. This resulted in delays and disappointed clients, as well as an increased workload for existing staff which lead to burnout and decreased productivity.

The Solution

To assist the CPA, meet the demand for Income Replacement Benefit (IRB) reports, YourLegal provided well-trained additional staff on a contract basis. By understanding the challenge faced by the CPA firm and providing targeted solutions, YourLegal was able to support Clarity CPA in meeting the needs of their clients and improving their business operations.

The impact of our

collaboration

Expert Analysis and Detailed Income Replacement Benefit (IRB) Reports

YourLegal promptly began collaborating with the forensic accounting firm to review the relevant financial documents and gather all necessary information. We carefully analyzed the data and prepared detailed Income Replacement Benefit reports, highlighting any potential issues or discrepancies

Ongoing Support for Insurance Claim Reports

Besides preparing the investigation reports, YourLegal also provided ongoing support to the forensic accounting firm, answering any questions they had and providing guidance on best practices for conducting insurance claim reportings.

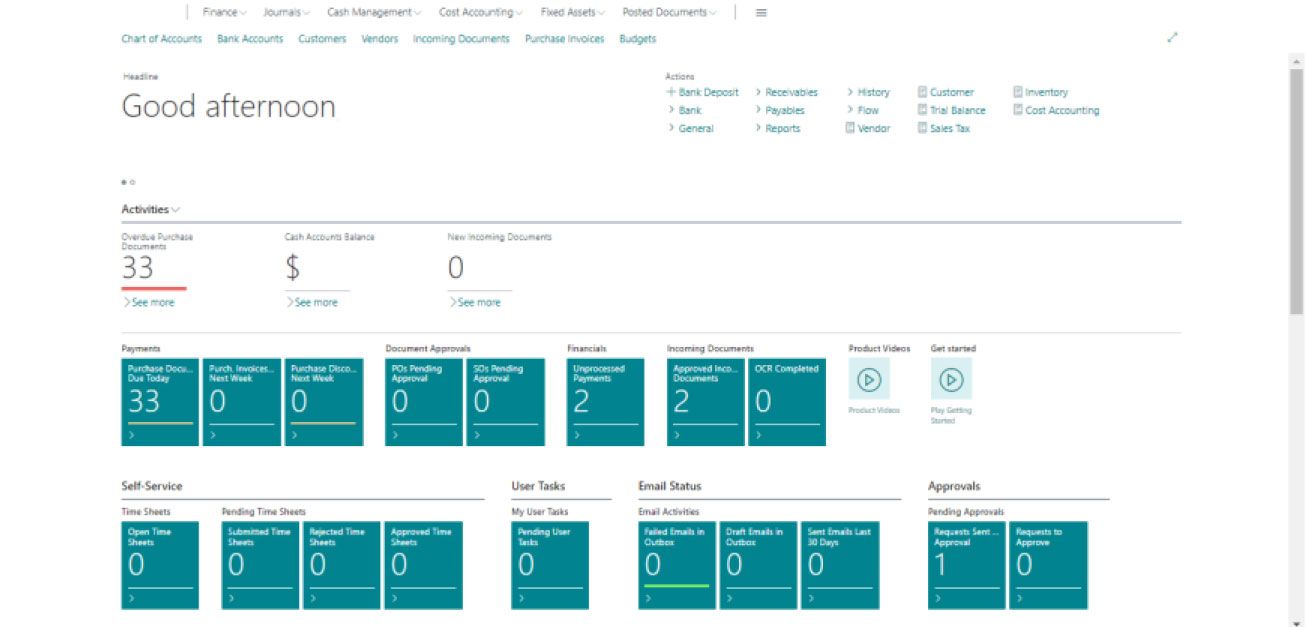

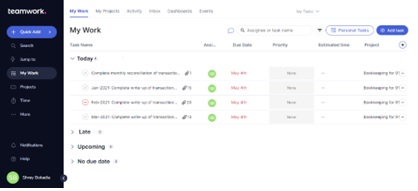

Tech Stack

Value Delivered

YourLegal was able to effectively collaborate with the forensic accounting firm to prepare thorough and accurate investigation reports for insurance claims. The firm was extremely satisfied with the level of service and expertise provided by YourLegal and plans to continue