How Bookkeeping helps you in Cost Saving, Tax Saving and Smooth Business Running!

How Bookkeeping helps you in Cost Saving, Tax Saving and Smooth Business Running!

Key Points

Every business whether it is small big or a conglomerate bookkeeping helps to Save Costs, Taxes, and Smooth Business Running! Yes, It might not be as good as the latest show on Netflix, but trust me, it’s a game-changer for your business.

In this blog, we will explore how mastering the basics of bookkeeping can save you money, cut down on taxes, and keep your business sailing smoothly through financial ups and downs.

But before diving into the deep waters of bookkeeping, let’s first grasp the basics.

What is bookkeeping?

It’s like maintaining a diary for your business’s financial affairs. Picture this: Every dollar coming in and every penny going out is diligently noted and neatly organized, just like entries in a personal journal.

For instance, imagine you own a small bakery. Every time a customer buys a cupcake or you purchase ingredients like flour and sugar, those transactions are recorded in your business diary. It’s a straightforward way of keeping tabs on your bakery’s financial story, making sure nothing slips through the cracks.

How Bookkeeping Helps You in Cost Savings:

Identifying Cost Inefficiencies:

One of the significant advantages of professional bookkeeping services is their knack for spotting cost inefficiencies within your business. These experts, with their keen eye for detail, thoroughly analyze your financial data. They can pinpoint unnecessary expenses, highlight budget discrepancies, and suggest strategies to save costs. Imagine it as having a financial detective on your team, ensuring your business operates efficiently and your profits are maximized.

Timely Expense Tracking and Tax Compliance:

Accurate and up-to-date financial records are crucial for tax compliance. Bookkeeping services make sure all your financial transactions are promptly recorded, allowing you to meet tax deadlines stress-free. By keeping track of income and expenses, these services help you maximize eligible deductions, reducing your tax liability.

Improved Cash Flow Management:

Maintaining a healthy cash flow is vital for business sustainability and growth. Bookkeeping services provide real-time insights into your cash flow, helping you make informed decisions on investments, expenses, and revenue generation. By tracking accounts receivable and payable, they help identify overdue payments or outstanding invoices. This enables you to take prompt action, ensuring a steady cash flow. It’s like having a financial GPS, guiding you through the twists and turns of revenue and expenses.

Strategic Financial Planning:

Accurate financial records are indispensable for strategic financial planning. Bookkeeping services provide comprehensive financial reports and statements, offering a clear overview of your business’s financial health. These reports enable you to identify trends, measure key performance indicators, and make data-driven decisions. It’s akin to having a roadmap for your business journey – guiding you towards long-term success and helping you avoid unnecessary financial risks.

How Bookkeeping Helps You in Saving Taxes:

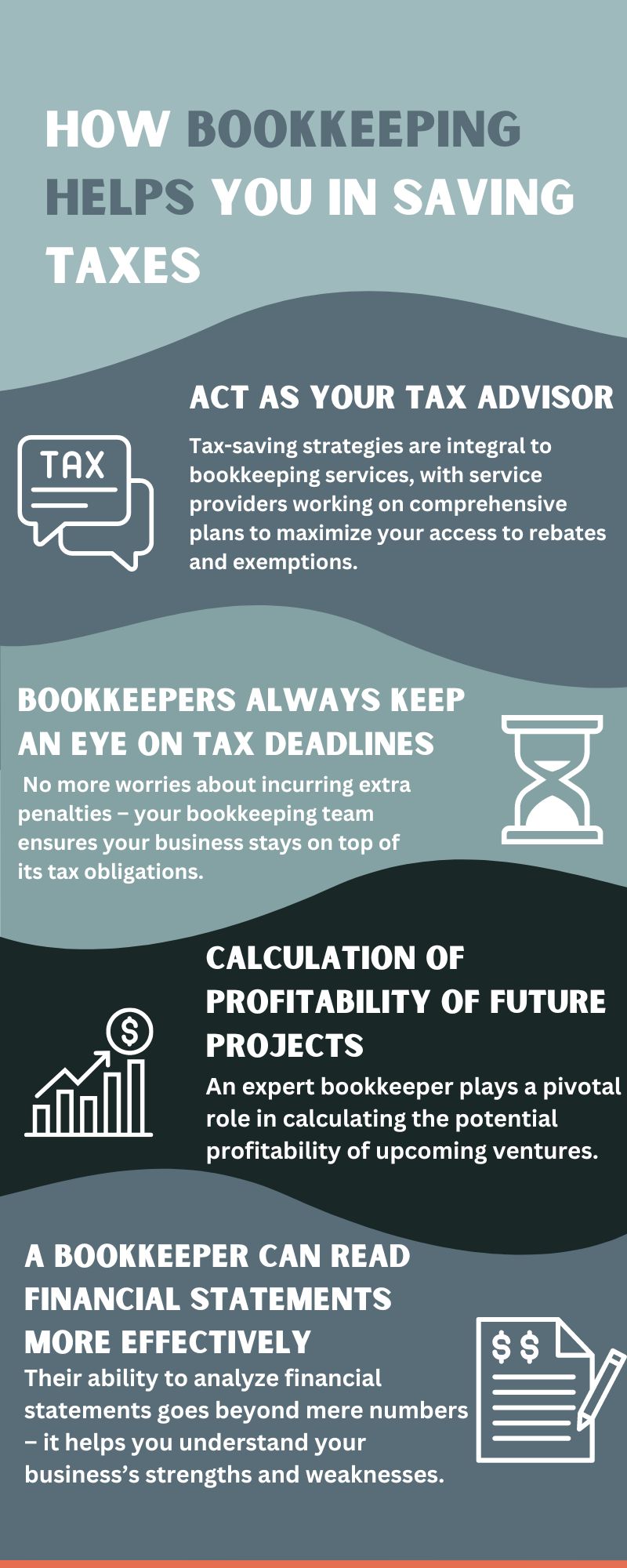

Act as Your Tax Advisor:

Navigating business regulations, laws, and taxation can be a daunting task for business owners. A proficient bookkeeper serves as your tax advisor, providing valuable insights during audits and managing your company’s accounts. Tax-saving strategies are integral to bookkeeping services, with service providers working on comprehensive plans to maximize your access to rebates and exemptions. By outsourcing bookkeeping tasks, you not only gain professional advice but also receive a tailored roadmap for tax-efficient goals, including analysis, comparison, and strategic financial statements.

Bookkeepers Always Keep an Eye on Tax Deadlines:

Ever found yourself panicking about tax deadlines? bookkeepers have got your back. They diligently keep track of tax deadlines, sparing you the stress of managing them yourself. No more worries about incurring extra penalties – your bookkeeping team ensures your business stays on top of its tax obligations.

Calculation of Profitability of Future Projects:

Predicting the profitability of future projects is a critical aspect of business planning. An expert bookkeeper plays a pivotal role in calculating the potential profitability of upcoming ventures. With their detailed analysis, you move beyond guesswork, allowing you to make informed investment decisions that lead to increased profits.

A Bookkeeper Can Read Financial Statements More Effectively:

Reading financial statements is an art, and a proficient bookkeeper excels at it. In the realm of bookkeeping, we’re talking about qualified and experienced professionals who handle multiple clients’ books. Their ability to analyze financial statements goes beyond mere numbers – it helps you understand your business’s strengths and weaknesses. Armed with this knowledge, you can strategically work towards generating more profit, making your financial journey smoother and more lucrative.

How Bookkeeping Helps in Ensuring Smooth Business Operations:

Staying on Track with Finances:

A proficient bookkeeper acts as the backbone for your business’s financial health. Regular bookkeeping, even for small businesses, forms the foundation for monitoring sales, expenses, profits, cash flow, and progress against set goals. It ensures that you have a clear understanding of your financial landscape, allowing for informed decision-making.

Efficiency During Holidays:

The holiday season can be hectic, but hiring a bookkeeper ensures your financial ship sails smoothly even when you’re away. A professional bookkeeper handles transactions, processes invoices, manages payments, and tackles payroll, maintaining financial order in your absence. They can identify potential bottlenecks in cash flow and spending patterns, aiding in necessary budget adjustments.

Valuable Business Advice:

Your bookkeeper is not just a number cruncher; they are also a fellow business owner and a trusted advisor. Engaging in discussions about your business goals and challenges with your bookkeeper can yield valuable insights. They can offer suggestions for cost-saving measures, strategies for increasing sales, and identify potential cash flow issues.

Prioritizing Workload:

During holidays, finding a balance between work and personal life can be challenging. A good bookkeeper helps you prioritize your workload by handling financial tasks that might otherwise consume your time. This enables you to focus on core business activities and enjoy quality time with your family.

Saving Time and Money:

Contrary to the initial belief that hiring additional personnel might be costly, a good bookkeeper ultimately saves you both time and money. Outsourcing financial tasks allows you to focus on areas where your expertise has a higher return on investment, potentially generating more revenue for your business.

In Bottom Line

Our exploration into the realm of bookkeeping reveals its indispensable role in business success. Regardless of size, businesses benefit from mastering the basics of bookkeeping, which acts as a compass for meticulous financial tracking and organization. Beyond the numbers, bookkeeping serves as a financial guardian, identifying inefficiencies for cost savings, ensuring tax compliance, and contributing to strategic financial planning.

As we navigate through the intricacies of bookkeeping, it becomes evident that this practice goes beyond being a mundane task. It is the unsung hero, providing businesses with stability, guidance, and the tools needed to thrive. From the precision of recording every financial detail to the strategic insights that aid in decision-making, bookkeeping proves to be a game-changer. It’s not just about saving costs and taxes; it’s about creating a foundation for businesses to sail smoothly through the unpredictable financial waters, ensuring long-term success.