Helping Texas Investor Tackle 5 Years of Back Taxes

About the

company

A Texas-based real estate investment company that focuses on acquiring and managing residential properties for rental purposes.

The Challenge

The Corporation had been experiencing rapid growth and had not been able to keep up with their tax compliance. The Client approached YourLegal in the middle of the tax season, seeking assistance with preparing their tax returns for the prior years.

The Solution

YourLegal immediately got to work, reviewing the Corporation’s financial records and gathering all necessary documentation. We also worked closely with the Corporation’s management to ensure that all income and expenses were accurately reported.

The impact of our

collaboration

Reduction in Tax Liability with Careful Review

Thorough review after carefully reviewing the Corporation’s financial records, YourLegal identified several deductions and credits that the Corporation was eligible for, which helped to reduce their tax liability. They also made sure to properly classify the Corporation’s employees as either employees or contractors, as this can have significant tax implications.

YourLegal’s efforts resulted in the successful preparation and filing of the real estate Corporation’s tax returns for the previous years, ensuring compliance with all relevant tax laws and regulations. The management expressed their extreme satisfaction with YourLegal’s level of service and expertise and plans to continue working with them in the future.

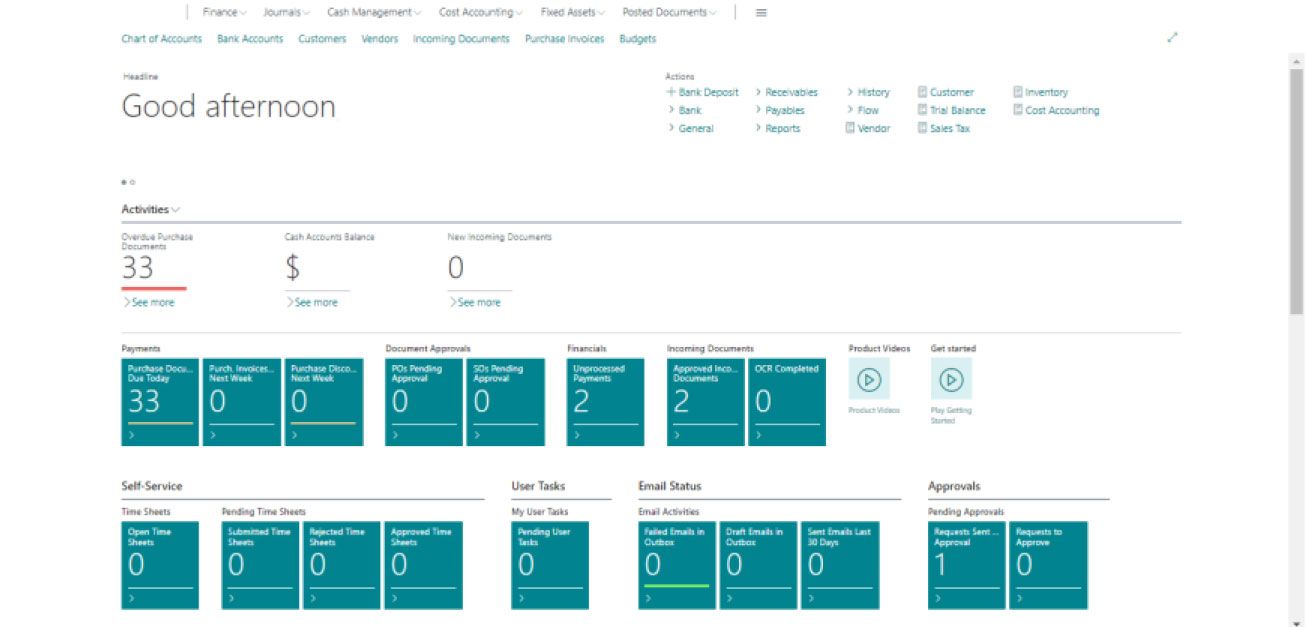

Tech Stack

Value Delivered

YourLegal helped the client to become compliant with tax filings and to catch up on bookkeeping. With YourLegal’s assistance, the client now has better control over its financials. YourLegal is also working to improve client’s financial reporting by including key performance indicators (KPIs), budgeting, and cash flow forecasting to help them improve their financial management.