Top 10 Free Accounting and Bookkeeping Apps for Small Businesses

Top 10 Free Accounting and Bookkeeping Apps for Small Businesses

Key Points

Maintaining a proper record of your money is important for any business whether it is small or large. It helps you stay one step ahead in the financial race and be aware of your earnings and any tax obligations.

However, managing finances without an entire accounting staff can be challenging for small businesses.

Accounting apps can help with that! They resemble your private money manager.

They organize all of your transactions automatically as soon as you link them to your corporate bank account. Additionally, they are compatible with your phone, allowing you to monitor your finances from anywhere. Cool, right?

Thus, we’ll be looking at several fantastic accounting apps in this blog that will help you develop your business and save time.

Apps for Small Business Accounting

Let’s discuss what a small business accounting app actually is. It assists you in monitoring the revenue, costs, and overall financial well-being of your company. In short, it’s a very useful tool for every small business.

These apps’ features include financial reporting, tracking expenses, and invoicing, without requiring an accounting degree. The apps make it easy for you to stay on top of your finances.

5 Important Features in Free Accounting Apps should have

Some important features you should know before we explore the list of the top free accounting apps:

- Invoicing: Good accounting software makes it easy for you to create and share with your clients invoices that appear professional.

- Expense tracking: An app should make it easy for you to classify and record your business spending. It is important to track your expenses accurately.

- Bank Integration: You should pick an app that integrates with your bank accounts, to ensure that your records are current and that you can effortlessly reconcile your transactions.

- Financial Reporting: The app should provide you with information like balance sheets and profit and loss statements to assist you in comprehending the financial success of your company.

- User-Friendly Interface: Lastly, but equally important, choose an app whose navigation is easy to understand and doesn’t require you to solve puzzles.

Best Free Accounting Apps for Small Businesses

Whether you are an iOS or Android user, there is an accounting software for every user. Many of these apps work with both kinds of smartphones, so you have versatility and convenience. Now, let’s explore some of the most popular accounting apps for small businesses.

Let’s take a closer look at each of these apps.

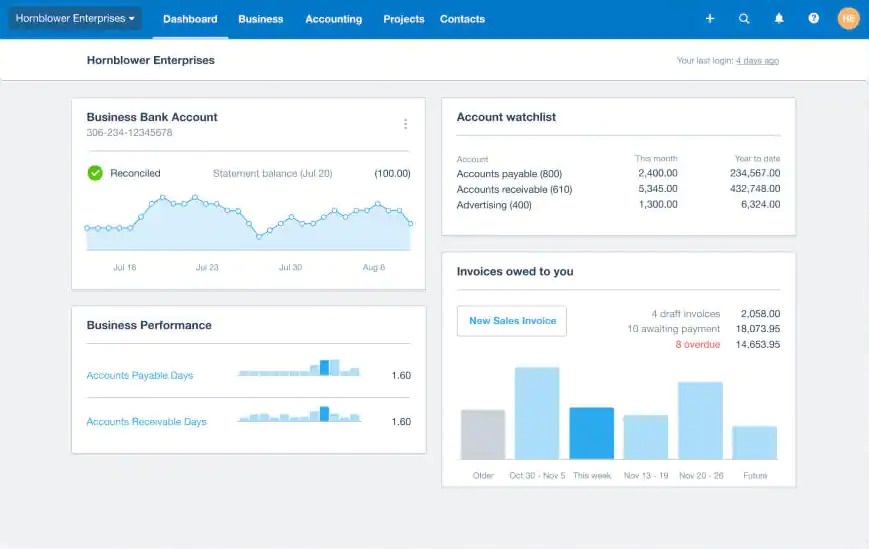

Xero

This software is extremely user-friendly and gives you a clear information of your bank balance, earnings, and cash flow. Have a complete view of your expenses at one place facilitates informed decision making.

Advantages:

– Just a simple tap and convert your quotes into invoices.

– Sending invoices simple with Xero.

– Helps in monitoring bank transactions.

– Maintains contact information and sends bills by email or messaging apps.

– Unlimited users and a variety of reports are available.

– Provides safe access to your data.

Limitations:

– Not as smart as the PC version.

– Does not notify you of past-due payments.

– Not able to turn the screen sideways.

Zoho Books

Zoho Books can help you make bills, send invoices, and manage your expenditure, it even accommodates multiple currencies for cross-border transactions. Your customers can use the client portal to view transaction updates.

Advantages:

– Generates customized invoices.

– Displays dashboard important performance metrics.

– Supports a large number of users and works with numerous payment channels.

– Provides a wealth of business reports.

Limitations:

– Doesn’t function well with apps other than Zoho.

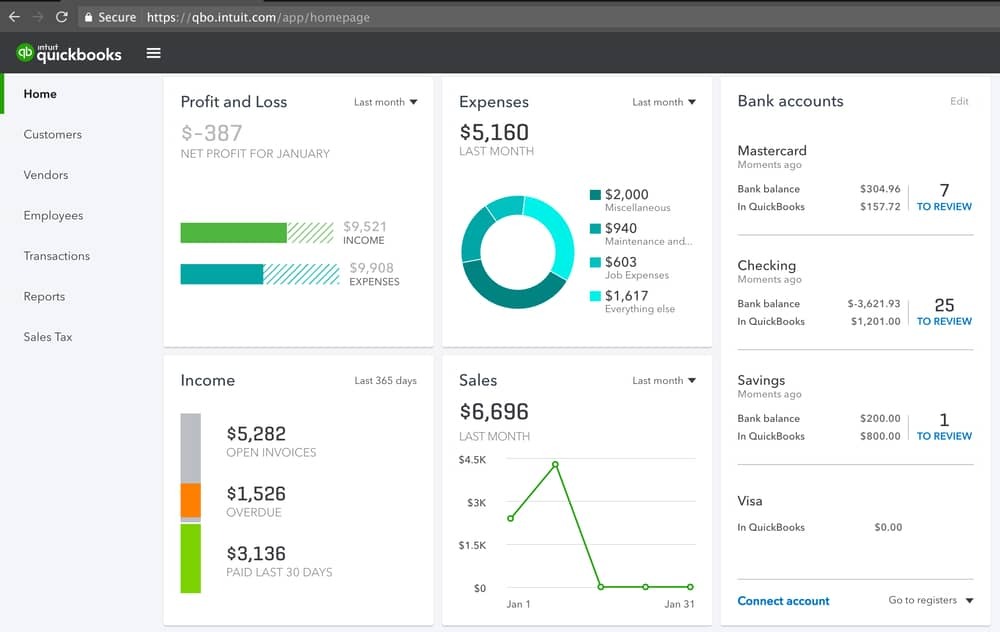

QuickBooks Online

While using QuickBooks Online, you can easily create, mail, and keep track of bills using this app. It gives your invoices a stylish appearance, additionally, it alerts you to your financial condition so that you can make better plans.

Advantages:

– Helps in creating bills.

– Monitors your expenses.

– Estimates your financial flow for the upcoming ninety days.

– Integrates with additional technologies, such as sophisticated inventory and CRM systems.

– Easy to set up and displays the earnings and losses for your company.

– Sorts bank transactions quickly.

– Simple to collaborate with others.

Limitations:

– Lacks some of the new features found in the standard version.

– To make direct payments, another QuickBooks account is required.

NetSuite

With NetSuite cloud accounting software, you may simplify your financial administration. It makes managing accounts receivable and payable, general ledger organization, and tax management effortless. You also get a complete report of your total financial performance and cash flow.

Advantages:

– Removes clumsy spreadsheets and redundant data entry.

– Offers dashboards and real-time metrics for simple company monitoring.

– Ensures compliance and expedites the financial closing.

– Tasks related to accounting are automated.

– Provides a solitary resource for up-to-date financial and operational information.

Limitations:

– A variable pricing system and extra fees.

– Needs specific knowledge and money set aside for upgrades.

– Limited alternatives for customer service and additional fees for round-the-clock help.

ZipBooks

ZipBooks provide you many functions like creating invoices and monitoring the performance of your business for free. However, the free plan has certain restrictions.

Advantages:

– You can create Infinite bills.

– Manages all of your clients and suppliers.

– Accepts payments via Paypal and Square

Limitations:

– You can only add one bank account.

– It only displays the most basic reports.

Sage Intacct

To scale with your business, Sage Intacct provides cloud-based payroll, HR, and accounting services. For present and future requirements, their AI-driven ERP and continuous accounting systems are there.

Advantages:

– It provides cutting-edge functionality.

– Committed support staff to assist with technical problems.

– Aids in managing the budget.

– Automates operational procedures.

– Enhances productivity, scalability, and agility.

– Promotes the expansion of businesses.

Limitations:

– There is no upfront cost.

– May be challenging to utilize.

– Small enterprises may incur significant costs.

– The cost of technical support is high.

Intuit QuickBooks

QuickBooks products are mostly aimed at small and medium-sized businesses. They include both on-premises and cloud-based accounting software. These applications help businesses process payroll, take payments, and manage their bills more efficiently.

Advantages:

– Simple to use and understand.

– Supports apps from other parties and integrates seamlessly with other systems.

– Offers helpful financial reports.

– Depending on the version, accessible from a computer, tablet, and phone.

– Makes error correction simpler.

– Accessing client information is convenient.

Limitations:

– Doesn’t include industry.

– Specific functionality like eCommerce, barcode scanning, or lot tracking.

– Few important reports other than accounting.

– Easily unstable and prone to system failures.

– Limitations on the quantity of users.

Acumatica

Acumatica is an accounting, operations, customer relations, vendor management, and personnel management application that helps the mentioned areas of corporate operations with effective management.

Advantages:

– With easy adaptability, it manages to meet the needs of growing enterprises.

– The application is accessible from any location with a good internet connection.

– Includes project management, CRM, financial management, etc.

– User-friendly and easy navigation.

– Interacts with widely used third-party programs.

– Reduces manual errors and tedious procedures.

– Automates several process procedures.

– Sophisticated security mechanisms for utmost privacy.

Limitations:

– No specifications catering to each industry.

– Mobile functionality is restricted.

– Customization can induce further complications.

– Needs technical experts for smooth operation.

Wave

Wave is an easy application for all starting firms. All the bookkeeping features are included for free, including the ability to monitor inflows and outflows from your bank and advantage of creating further sub-firms.

Advantages:

– Easy and user-friendly application.

– Provides access to your every bank account.

– Keeps a tab on all your transactions.

– Provides reports you can utilize for various purposes.

– Also connects to HubSpot CRM.

Limitations:

– No payment of the outstanding.

– Mobile application has bugs.

ProfitBooks

ProfitBooks is an online accounting software that is growing at a fast pace because of its easy interface. Without requiring any accounting knowledge, users can manage inventory, and spending ratios, and make remarkable invoices. With just a few clicks, users can obtain insights into their business and transactional data with their accountants, empowering them to make more evolved decisions.

Advantages:

– A user-friendly dashboard interface.

– Cutting-edge modules seamless OS.

– SAAS-based payment system and getaway.

– The availability of mobile apps, multi-level security, simple cash flow management, and currency comparison.

Limitations:

A few difficulties have been recorded while using the app.

– Customer service needs to be a little versatile.

– Inclining towards the expensive side.

Conclusion:

Now as you know it’s no longer necessary to suffer through financial management for your small business because of this free accounting softwares! They perfectly suit your demands, regardless of whether you run a small business, consult, or are a freelancer. So why hold off? Take expert financial management with these applications by exploring them now!